One of the most highly used strategy in futures trading is trading spreads. Effectively, traders are trading the correlation (or cointegration more correctly) between two products.

For example, there is going to be a strong relationship between Crude Oil and Brent. So it makes sense that they would move in-sync with one another. As outright futures traders, we are not going to want to trade spreads in the true sense. Rather we are looking to trade correlated markets and use them as indicators.

When two correlated markets trade on a given day, it makes sense that they should be trading at the very least in the same direction. When that correlation breaks down and they get out-of-sync, it gives us an opportunity to find a profitable trade.

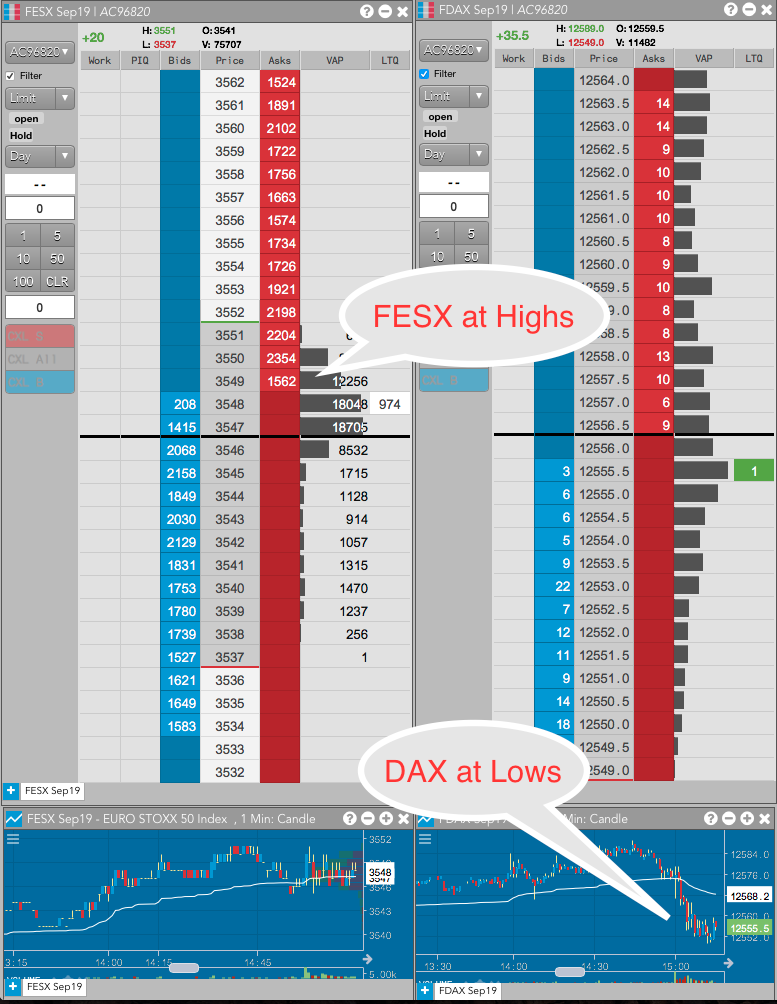

Two of my key markets are the FESX and FDAX, the European equity futures contracts. Both are related and highly correlated and as such should move in sync with one another.

When they don’t it can at times be an opportunity. In the example below, the DAX on the right it trading at lows on the day. While the FESX is at highs. Which one is wrong is not for me to say, but what I do know is that they are likely to even up in time.

So my trade here is to short the FESX assuming that it won’t break out without its companion (and often times leader) the DAX trading lower. It also helped us in this situation as there was a key resistance level in the FESX overhead at 3550 and a major announcement (ECB Rate Decision) happening later in the day.

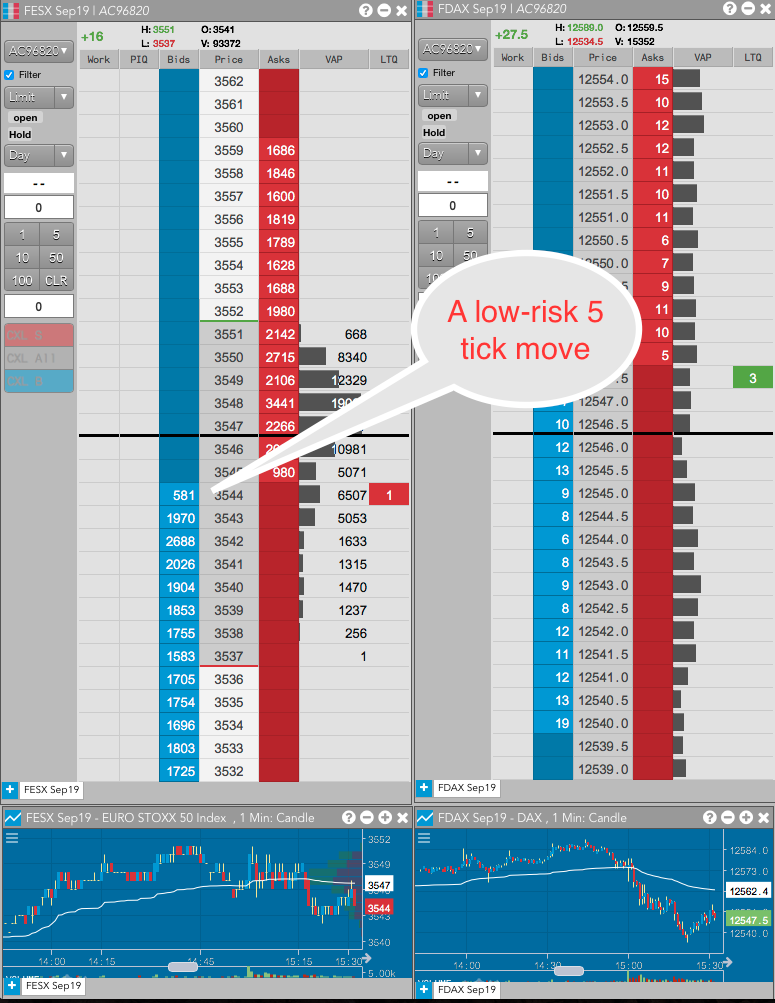

As you can see later in the session, the FESX continued to break down and we had ourselves a very low-risk opportunity to short the FESX around the 3549 level.

Bottom Line: One of the best ways to trade futures markets is with the help of correlated products. Find pairs of products that make sense that they would have a relationship on a fundamental level then watch how they trade on a daily basis to get a feel for that relationship and how they move together.