Welcome back to part 3 of my month long Futures Trading Bootcamp.

If you haven’t already, you can read week 1 and week 2, and start building your DOM trading skills.

In the previous two weeks, our goal has been to adjust our eyes to the DOM and to start being able to spot areas where there is buying and selling going on.

We covered some interesting concepts that centered largely on the idea of volume being traded at each price level.

This week we will be continuing with our exercises and building on what we have learnt.

This week our focus is on correlations.

Hopefully it shouldn’t come as a surprise to you that different markets are related to one another.

Sometimes those relationships are obvious, sometimes they are not so obvious.

A good example might be relationship between stocks and bonds.

Conventional wisdom would suggest that when stocks go up bonds go down – or vice versa. Bonds represent safety – stocks represent risk. However while this relationship has held true for a number of years, in recent times we’ve seen bond prices trade upward along with stock prices and that historical relationship has become distorted.

Another example of a related or correlated market is a currency and equity index. For example the Australian stock market should have a strong level of correlation between itself and its currency. Drivers of the economy will have an impact on both stocks and the currency.

However correlations are not always forever and they’re certainly not always perfect.

But the good news for us is that they don’t have to be.

So how does this help us with our DOM trading? Well we can use correlations to help improve our entries and exits, which is ultimately our goal.

Exercise

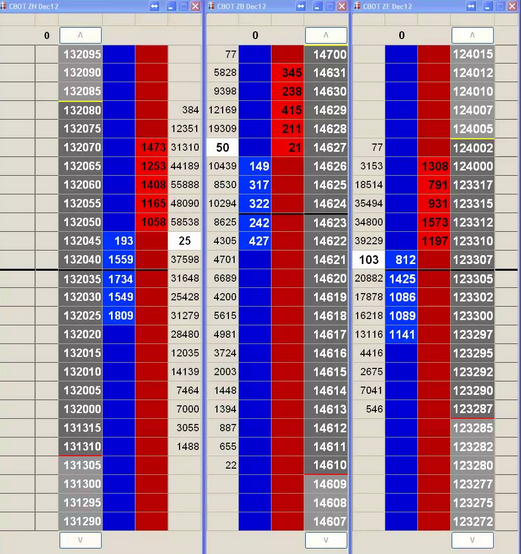

This week your task is to look for a market that is correlated to the one you have been trading. If you’ve been trading the US 10-year note (ZN) then your task is easy. You can see very clearly that there is a very strong correlation between the ZN, ZB and ZT. All the bond futures in reality.

You can continue with last weeks exercise – spoting buying and selling areas where there are high volume profile ledges and levels – however now I want you to add in the correlated market as a pseudo indicator.

I want you to look how all two or three markets are trading, in terms of where they are in relation to the high and low of the day.

For example, let’s say you spot a volume profile ledge in the ZN toward the bottom of the days range. You also see that there is buying going on and 3-4 times the size of the bid has traded at the price.

However when you look at the ZB you see that in fact it has broken through the low of day and is trading toward the very bottom of its range.

Now because these markets are correlated we can assume that the fact that the correlated market is pointing in one direction and we are looking to trade in another might cause an issue.

For the point of the exercise I want you to observe what happens when the correlated market is headed in the same direction as your potential trade vs when it’s headed in the opposite direction.

It’s important at this point to not try and read the DOM on the correlated market. It’s hard enough getting used to reading one DOM, let alone multiple. All I want you to do is to use the correlated market/s as an indicator. Think about it like a clock. Is it pointing up or is it pointing down?

How does that impact my trade?

Now it’s also important to keep trading a lot. Keep taking all trades where there is a significant volume profile level and size printing at the bid or offer. The goal is to give you as many opportunities to trade as possible and the more the better. Don’t worry about being right during the exercises.

What we are doing with this weeks exercise is just building on that.

You are just making mental notes this week about how the correlated market – or it’s current direction – impacts our main market.

It’s like our own special indicator.

Things to note about correlated markets

Unfortunately correlations aren’t always there and are not always perfect – but they sure do help.

If you’re trading the bonds then there is a pretty good chance the correlations will be there and will be strong. You’ll see the same thing with the Bund/Bobl/Schatz on Eurex.

If you’re trading equities look at the EuroStoxx/ Dax.

In the US test out the ES/YM.

Try the Aussie SPI/AUD.

Find one that is correlated and have it there as an indicator and watch how it impacts your chosen market.

As always if you need to clarify the exercise a bit more please feel free to leave a comment and I’ll be more than happy to help.